The Basic Principles Of Dubai Company Expert Services

Wiki Article

The Best Strategy To Use For Dubai Company Expert Services

Table of ContentsDubai Company Expert Services - TruthsThe Single Strategy To Use For Dubai Company Expert ServicesOur Dubai Company Expert Services IdeasGetting My Dubai Company Expert Services To WorkThe smart Trick of Dubai Company Expert Services That Nobody is DiscussingExamine This Report on Dubai Company Expert ServicesThe Buzz on Dubai Company Expert Services

The earnings tax rate is 0-17%. The personal income tax obligation price is also reduced as compared to various other countries. The personal revenue tax rate is 0-20%. One of the largest advantages of signing up a business in Singapore is that you are not needed to pay taxes on funding gains. Dividends are additionally tax-free here.

It is very easy to start business from Singapore to throughout the world.

The start-ups identified via the Start-up India effort are offered ample advantages for beginning their very own company in India. Based on the Start-up India Activity plan, the followings problems should be met in order to be eligible as Start-up: Being integrated or signed up in India approximately ten years from its day of incorporation.

The Ultimate Guide To Dubai Company Expert Services

100 crore. Anyone interested in establishing up a startup can load up a on the internet site and upload particular papers. The government likewise offers checklists of facilitators of patents as well as trademarks.The government will certainly bear all facilitator costs as well as the start-up will birth only the statutory fees. They will enjoy 80% A is set-up by government to give funds to the start-ups as financial backing. The federal government is additionally offering warranty to the lending institutions to encourage banks and also various other banks for supplying venture resources.

This will help startups to draw in even more financiers. Hereafter plan, the start-ups will certainly have an option to choose between the VCs, providing the freedom to choose their financiers. In situation of leave A startup can close its business within 90 days from the date of application of winding up The government has recommended to hold 2 startup feasts every year both across the country and globally to allow the different stakeholders of a start-up to satisfy.

See This Report about Dubai Company Expert Services

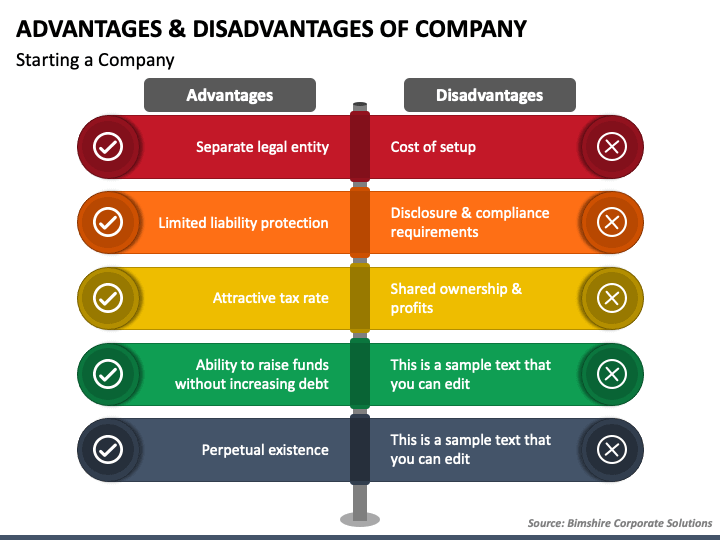

Minimal companies can be a wonderful option for lots of property investors however they're wrong for everybody. Some proprietors may actually be far better off owning building in their individual name. We'll cover the benefits and drawbacks of minimal business, to help you choose if a minimal company is the right alternative for your home financial investment organization.As a firm supervisor, you have the flexibility to choose what to do with the earnings. You can purchase additional homes, save into a tax-efficient pension or pay the earnings tactically making use of rewards. This adaptability can assist with your individual tax obligation preparation contrasted to directly possessed properties. You can learn more concerning tax for building financiers in our expert-authored overview, Introduction to Real Estate Tax.

If your revenues are going up, this is certainly something you should keep a close eye on and you could desire to consider a minimal business. Dubai Company Expert Services. As a supervisor of a company, you'll legitimately be needed to maintain exact firm and economic records and also submit the ideal accounts as well as returns to Companies Home and HMRC.

Dubai Company Expert Services for Dummies

That's exactly what we do right here at Provestor: we're a You'll need to budget around 1000 a year for a minimal company accounting professional and make certain that the tax obligation benefits of a restricted company outweigh this extra cost. Something that few individuals discuss is dual tax. In a restricted firm, you pay company tax on your earnings. Dubai Company Expert Services.It's worth locating a professional minimal firm home loan broker that can discover the very best offer for you. In general, there's fairly a great deal to think about. There are plenty of advantages yet additionally extra costs and also more intricacy. Crunch the numbers or conversation to a specialist to make certain that the tax financial savings exceed the additional costs of a minimal firm.

A private limited firm is a kind of firm that has restricted obligation and shares that are not openly transferable. The proprietors' or members' properties are therefore protected in case of organization failure. Still, it has to be stressed, this defense just uses to their shareholdings - any type of money owed by the company remains.

Some Ideas on Dubai Company Expert Services You Need To Know

One major downside for new organizations is that establishing up an exclusive restricted company can be complicated and pricey. To our website shield themselves from liability, firms have to stick to specific rules when integrating, including filing write-ups of organization with Business Home within 14 days of incorporation and the annual confirmation declaration.

The most typical are Sole Trader, Collaboration, and Exclusive Minimal Business. There are many benefits of a private limited company, so it is the most preferred alternative. Right here we will certainly be going over the benefits of a Personal Limited Firm. Limited Liability The most substantial advantage of a private limited firm is that the proprietors have actually restricted responsibility.

If the company goes insolvent, the proprietors are only responsible for the quantity they have actually invested in the business. Any kind of company's cash remains with the firm as well as does not fall on the owners' shoulders. This can be a considerable advantage for brand-new organizations as it safeguards their assets from possible business failures.

look at this site

The Basic Principles Of Dubai Company Expert Services

Tax obligation Reliable Personal minimal business are tax efficient as they can assert corporation tax obligation alleviation on their profits. This can be a significant conserving for businesses as well as increase revenues. In enhancement, private minimal business can pay returns to their shareholders, which are additionally taxed at a reduced rate. Furthermore, there are several various other tax benefits readily available to firms, such as capital allocations as well as R&D tax obligation debts.

This suggests that the company can acquire with various other companies and also individuals as well as is liable for its financial obligations. The only money that can be asserted directly in the company's commitments as well as not those sustained by its owners on part of the company is shareholders.

This can be helpful for little businesses that do not have the time or sources to handle all the administrative tasks themselves. Flexible Administration Structure Private restricted business are renowned for single traders click here to find out more or small services that do not have the sources to establish a public minimal business. This can be helpful for firms that intend to keep control of their operations within a small group of people.

All About Dubai Company Expert Services

This is due to the fact that exclusive restricted business are extra legitimate as well as well-known than single traders or partnerships. In enhancement, exclusive minimal firms usually have their internet site as well as letterhead, providing customers and also distributors a feeling of depend on in business. Security From Creditors As discussed earlier, among the essential advantages of an exclusive minimal firm is that it supplies protection from lenders.If the business enters into financial debt or insolvency, lenders can not seek straight settlement from the individual possessions of the service's owners. This can be necessary protection for the investors as well as supervisors as it limits their liability. This indicates that if the firm goes bankrupt, the owners are not personally liable for any type of cash owed by the firm.

Report this wiki page